What is an Epic Retirement really?

How to Have an Epic Retirement is a book I published just over two years ago in Australia. It remains the #1 bestselling retirement book there today... but it's more than that.

Welcome!

This is my first official North American newsletter—created to serve readers in the US and Canada with more localised Epic Retirement education. We’re steadily expanding the way we deliver Epic Retirement around the world. Having a global voice and and the Epic Retirement club for conversation is one thing, but people need clear, easy-to-use guidance on how their own retirement systems work. That’s where I focus: global on the big themes—purpose, health, happiness, fulfilment—and local on the financial systems and rules that shape retirement.

This North American newsletter is part of our global reshaping of our Prime Time and Epic Retirement education into three regions:

Australia and New Zealand: au.epicretirement.net

North America: na.epicretirement.net

So… if you’ve discovered me through the rapidly growing Epic Retirement Club, you might be wondering what all this Epic Retirement palava is about… or maybe you’ve been part of our international newsletter for some time. Either way - let me properly introduce what it means to have an Epic Retirement, just once, to kick off this new North American newsletter.

How to Have an Epic Retirement is a book I published just over two years ago in Australia. It’s still the #1 bestselling retirement book there today, and even reached #2 on the national self-help list for Australian authors. It’s designed to be ‘the guidebook’ for modern retirement. The UK edition launches in December, and we’re working through the best way to bring it to North America and Canada.

Since then, I’ve released a second book for those in pre-retirement who aren’t keen on the old-style retirement narrative. It was an instant bestseller. It’s called Prime Time: 27 Lessons for the New Midlife—and it’s all about making the years before retirement exciting while you’re living them and effective in building what comes next. This is in line with the changing expectations of modern midlifers - who have access to retirement savings; and don’t need to wait for retirement to start living their best life.

What excites me most is that the frameworks from Epic Retirement—and its prequel Prime Time—work anywhere in the western world. Wherever you are, these should be the years you feel most energised about life, and this approach helps us navigate them with confidence.

So, welcome. I hope you enjoy reading along. You can find the archives anytime at na.epicretirement.net.

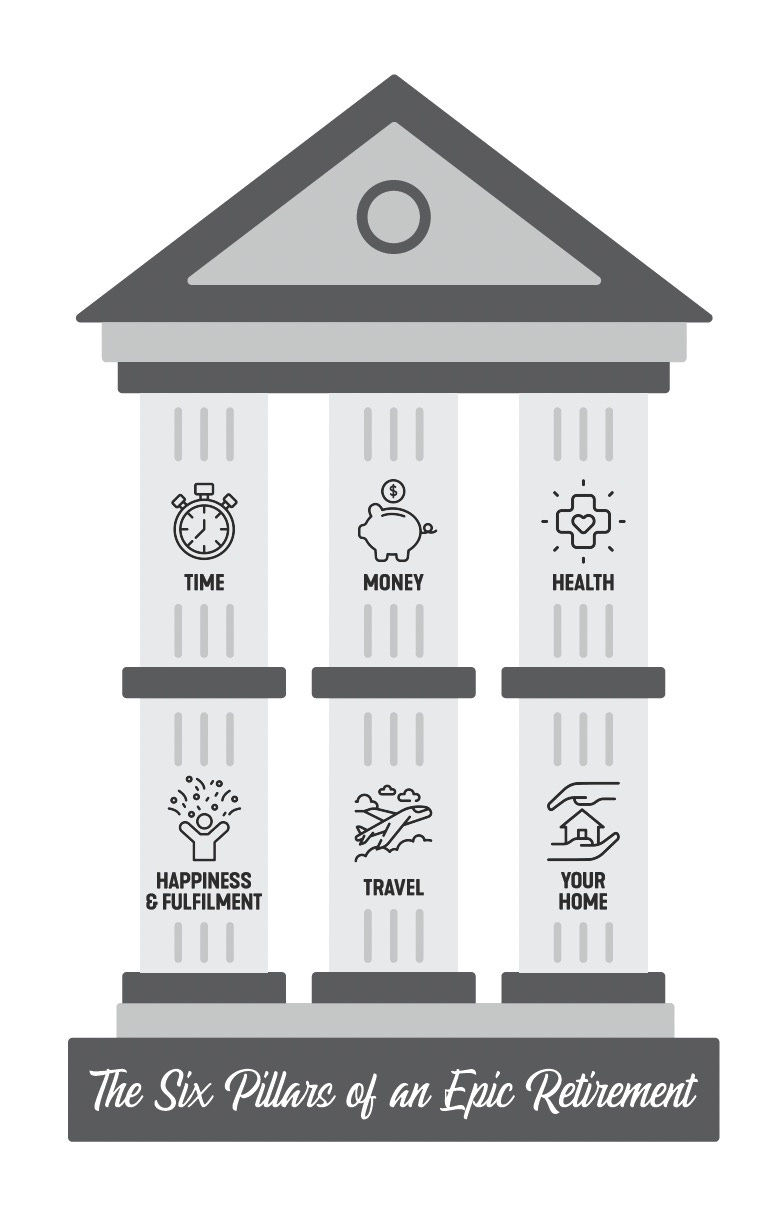

The six pillars of an epic retirement

How to Have an Epic Retirement is built on a six-pillar framework that, frankly, frames modern retirement really well and it’s universal - no matter where in the world you live. Let me talk you through it. Maybe it’ll help you with your planning.

Now, let’s run through the pillars so you can get a feel for how they work:

Pillar 1: Time

The first pillar is time, or understanding how long you might live. To have an epic retirement you need to put the number of years ahead of you in life into perspective. Most of us assume that life is short. There’s a new reality. In the last 50 years most people have gained 15 or more years of life expectancy in the western world. Australians that are 65 today now have a one in four chance of living to 94 for men, 95 for women and 97 for a couple. In the UK, people born after 1971 have a 50% chance of living to 100. Time and longevity is actually the most important first-thing to consider when you start contemplating how you’ll plan for your retirement. If you know you have a reasonable chance of living longer, then you need to lean into it, adjusting every other decision you make, and every plan that you have to fit this picture of a longer life. And you won’t just want to think about your lifespan. You also have your healthspan to consider.

When you consider your time, it lays perspective on who you want to spend that time with and what you want to achieve during it. Are there people that are really important to you in this phase of life that you want to be near, and things that you feel passionate about? We want to identify these early - so we build our plans around them. Time is a crucial consideration, and it sets the basis for many of our goals.

Pillar 2: Financial Confidence

This is about understanding how your money will work in retirement so you can make decisions with confidence.

You don’t need to be rich to have an epic retirement, you just need to know how your big financial picture works and have confidence to shape it for your years ahead.

You need to understand your layers of income in retirement – government pension, pension fund income, investment income and income from working. You then need to review your cost of living and lifestyle expenses bringing them into line with your income. You need to consider your asset mix and whether it’s appropriate for the next stage of life. And you need to understand your liabilities and how you can end up owning your own home before you retire, and minimising debt that’s not worth carrying anymore.

Your goal through your midlife, wealthy or not should be to put yourself in a position to have the ability to live in comfort in retirement. Of course there’s lots more to talk about in money - from your investment strategy to the legacy you want to leave your children and grandchildren. Each plays an important role in how you live your life over the years ahead.

Pillar 3: Happiness and fulfilment

The third pillar is your happiness and fulfilment. If you’re going to spend 25-35 years in retirement, you’ll need to consider what you plan to do with your time, and how you’re going to get fulfilment.

Work is not off the table in a modern retirement, but most people want to shift to doing work they enjoy, because it interests them, rather than grind away at a job they hate. Alongside this, it’s critical to build up your epic pursuits – pastimes that you are passionate enough about to keep investing and growing your skills in. It’s also critical to cultivate community activities that you love, that give you a sense of meaning, purpose and belonging, as well as the benefits of social interaction which have been proven to help us live longer.

Pillar 4: Your Health

The fourth pillar is your health. You can’t have an epic retirement without your health. I mean it. All the money in the world is pointless if you’re stuck in a chair unable to enjoy your life because you’re struggling with chronic disease. So start thinking about three things. Understand the science of modern ageing, and how experts are saying we can slow the physical and mental declines in our healthspan, and look at what you can practically do to help yourself. Think about how you’ll make the right types of exercise and nutrition a fundamental part of your everyday life. And work on your prevention of chronic disease - both with proactive steps to do your government-funded or healthcare-funded checks regularly and by monitoring the right biometrics in your body to see problems as they arise and tackle them quickly.

Pillar 5: Travel

For many, travel is the biggest dream of retirement — whether that’s overseas adventures, road trips, or more modest getaways. But travel takes planning, budgeting, and prioritising. Creating a bucket list, costing it out, and sequencing trips over time helps ensure you get the experiences you want while you’re healthy enough to enjoy them.

Pillar 6: Your Home as You Age

And the last pillar is properly thinking about your home as you age.

When we retire we’re often excited for the here and now, so the housing choices you make can be bold and lifestyle oriented in the first years, but it’s sensible as you reach your seventies to start thinking more practically about where you might want to live, whether you can move into a lower maintenance property without stairs, and how you can be located near healthcare services. None of us want to end up in aged care, in any country, unless we have to. And the best way to minimise your risk of having to go into aged care is by really thinking about where you live as time goes on.

You’ll also want to consider how care in the home works in the place you plan to live. This is the dominating future for care as hospitals become limited in the services they want to offer the ageing, and aged care becomes chiefly for those suffering severe dementia, or at the end of life.

And there you have it - 400+ pages of retirement education boiled down to a tiny overview.

The perfect excuse

Here in Australia (where I live), it’s the first days of spring, and I’ve made a promise to myself: early morning exercise and early nights — no more late book-editing marathons. It feels good to be making small shifts that add up.

If you’re looking for a nudge yourself, pick one small change this season. It doesn’t need to be dramatic. Get outside a little earlier, tweak a meal, switch off the screens half an hour before bed. Small changes stack up quickly, especially when you give yourself permission to begin again with the seasons.

That’s really what the years before retirement — the time I call our Prime Time — are all about. It’s not a one-way rush into the next phase, but a stage where we embrace living on our own terms, building flexibility, choice, health and enjoyment into life while also laying the financial foundations. Leaning into shifts, not overhauls, is what creates more energy, more freedom, and more control to shape the life you want.

And because retirement is both a global and a deeply local experience, I’ve been making a few shifts here too. The systems that shape it — pensions, healthcare, housing — vary so much by country. That’s why I now write region-specific newsletters, so you can get information and stories that make sense where you live.

North America & Rest of World: na.epicretirement.net

Australia & New Zealand: au.epicretirement.net

And for those not quite ready for retirement, but wanting to embrace the opportunities of midlife, there’s also the Prime Time Newsletter — a global, universal edition that’s growing quickly: primetimers.net.

You can subscribe or unsubscribe from the newsletters that matter to you - knowing they will be more relevant than ever - but each is hosted separately on Substack.

Thanks for being part of this journey. Wherever you are, I hope you find a moment this week to reset, recharge, and do something joyful.

See you soon, Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Hi Bec. I am already a fan of your podcast and Australian Substack, so it’s exciting to see that you now have one for North America!

Good

Work!! Bravo!!